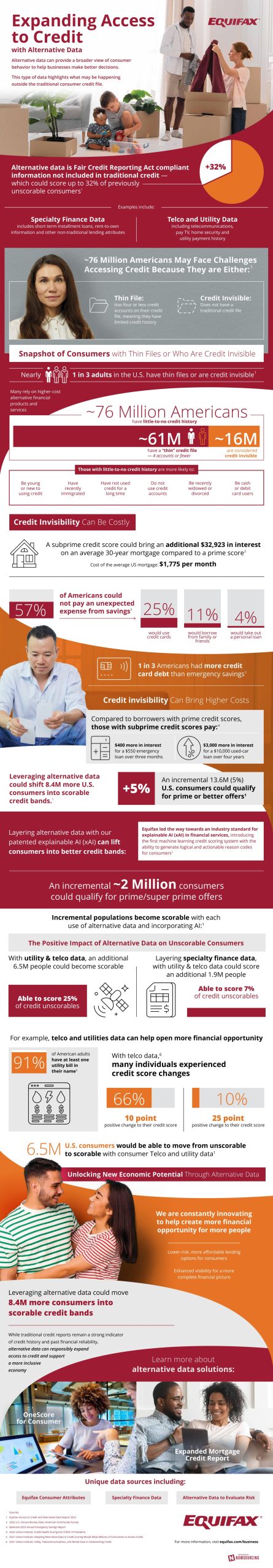

Credit invisibility can be a major barrier to financial security, and millions of Americans struggle with this issue. In fact, roughly 76 million Americans have little-to-no credit history, placing them in a low credit score band. Many of these individuals rely on , which add up over time.

Luckily, there are solutions. has the potential to shift 8.4 million Americans into scorable credit bands. Alternative data is information that is not included in traditional credit and is compliant with the Fair Credit Reporting Act. Key examples include specialty finance data and telco and utility data. The former includes short term installment loans, rent-to-own information, and other non-traditional lending attributes. The latter includes telecommunications, pay TV, home security, and utility payment history.

Equifax is a company that is dedicated to creating financial opportunities and supporting individuals in taking advantage of said opportunities. It uses alternative data to reach this goal. More specifically, Equifax layers alternative data with its patented explainable AI to boost individuals into better credit scores.

While traditional credit reports are still a strong representation of credit history and past financial reliability, alternative data is also useful and can expand access to credit. It provides a more complete financial picture, allowing a broader group of people to obtain scorable credit bands.